- Accountedge pro 2015 software#

- Accountedge pro 2015 free#

Accountedge pro 2015 free#

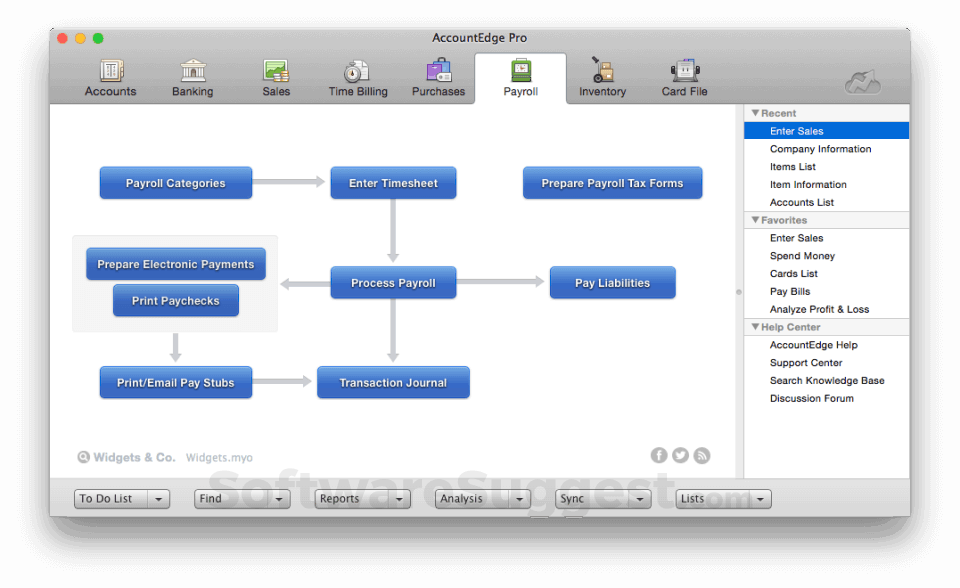

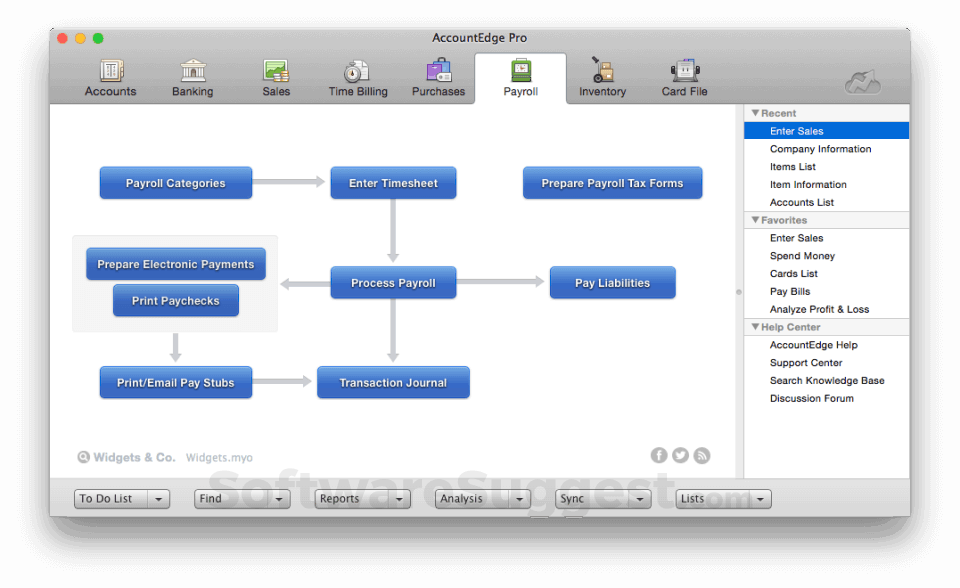

When looking at the SaaS Accounting applications, we could easily review over forty different products if we were free of resource constraints. This year’s review includes Acclivity AccountEdge Pro 2014, QuickBooks Pro 2014, and Sage 50 Premium Accounting 2015.

We generally limit this category to tools like QuickBooks Pro/Premier, Sage 50 US Edition Pro/Premier/Quantum, Acclivity AccountEdge Pro, Center Point Accounting, CYMA, and many others. On-Premises Small Business Accounting is defined as traditional, locally-installed general ledger and small business management tools which are designed to be primarily used by the client.

Accountedge pro 2015 software#

Software as a Service (SaaS) Accounting. We break small business accounting applications into two groups: If used regularly, these tools can convert unorganized, unprofitable clients into profitable client relationships for the future. Since these new tools are simple, and are primarily designed to provide business owners with DIY reporting while filling the critical need in assembling electronic lists of transactions for use by accountants and tax preparers. The microbusiness solutions are intended for those who are not using any accounting software, which some publishers estimate is as high as 80% of small businesses. Many professionals express concern about supporting multiple packages, but these new cloud packages for microbusinesses are not designed to replace the traditional on-premises accounting software applications like QuickBooks Pro. While some detractors wish these solutions had more features, the key thing to remember is that micro businesses are largely s need fewer features but more automation and simplicity than the small business, who most likely has someone with training in basic bookkeeping. Just as many individuals use Quicken, Mint, or Wave Personal to track their household finances, the self-employed and micro-businesses use tools like Wave Accounting, FreshBooks, Kashoo, Sage One, Xero, or QuickBooks Online. The good news is that accounting software is available to meet the needs of not only small businesses, but also micro businesses and the self-employed. Where firms might have deployed exclusively Sage 50 Premium (Peachtree), Acclivity AccountEdge Pro (formerly MYOB) or QuickBooks Pro in the past, we also did a lot more work assembling shoeboxes into general ledgers using Excel and columnar pads than most of us want to do today.

Unless your firm has a very homogeneous group of clients in a one or maybe two industries, you will have to deal with more than one accounting system. Many applications are available which clients can use to maintain a competent general ledger (with or without your assistance), but your challenge is to find the right solution for your client’s business, your client’s employees, and your firm. The solution needs to meet your needs, be easy to use, should fit within your budget, and should be pleasant enough to use that the client will actually keep their books after the first week or two. Selecting a small business accounting package is, in some ways, like purchasing a piece of home exercise equipment. Tax season 2014 has passed, and it’s time for many of our readers who are in public accounting to deal with those simmering accounting messes we discovered during the winter before they get any worse.

0 kommentar(er)

0 kommentar(er)